Featured

Table of Contents

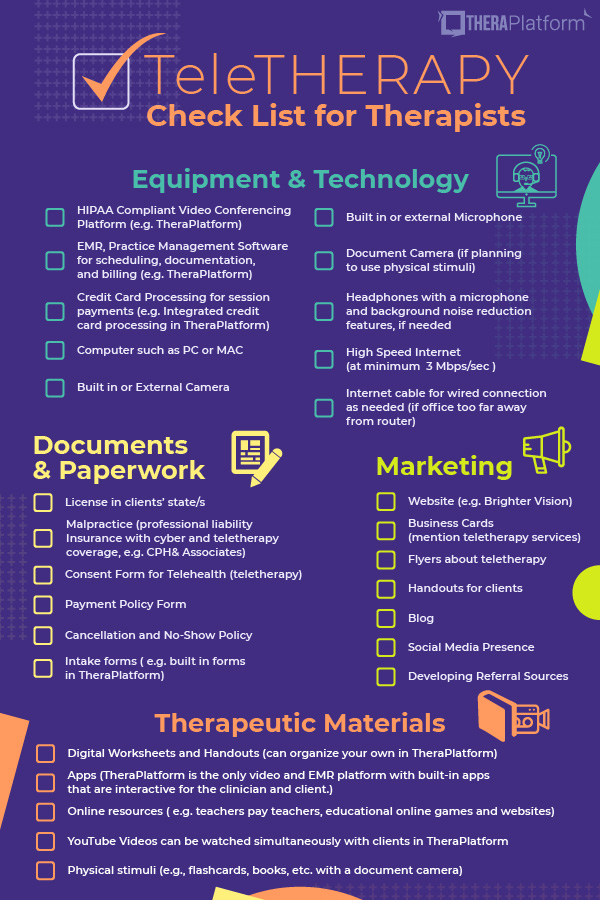

When you have actually discovered the appropriate remote treatment task, it's time to prepare your virtual method for success. Right here are the vital elements to think about: Obtain a reliable, high-speed web connection (at the very least 10 Mbps), a computer system or laptop computer that fulfills your telehealth platform's demands, and a top notch web cam and microphone for clear video clip and audio.

Reserve a silent, personal room or area for your teletherapy sessions. Make sure the location is well-lit, with a non-distracting history that represents your expert setup. Usage noise-reducing strategies and keep privacy by avoiding disruptions during sessions. Change your therapeutic style to the online setting. Use active listening, preserve eye call by looking at the camera, and take notice of your tone and body language.

Functioning from another location gets rid of the requirement for a physical office, reducing expenses connected to rent, energies, and upkeep. You additionally conserve money and time on travelling, which can reduce anxiety and boost general health. Remote therapy boosts accessibility to take care of customers in backwoods, with limited wheelchair, or encountering other barriers to in-person therapy.

Supporting Cluster: Niche Remote Services

Functioning remotely can often feel separating, lacking face-to-face communications with associates and clients. Dealing with customer emergency situations or dilemmas from a distance can be challenging. Telehealth calls for clear methods, emergency calls, and familiarity with regional resources to ensure customer safety and security and proper care.

Each state has its own legislations and regulations for teletherapy technique, consisting of licensing demands, informed authorization, and insurance policy compensation. To prosper long-lasting as a remote specialist, emphasis on growing professionally and adapting to the changing telehealth setting.

What You Really Need for Portable Success

A crossbreed version can supply adaptability, lower display exhaustion, and permit an extra progressive shift to totally remote work. Attempt different combinations of online and face-to-face sessions to discover the ideal balance for you and your clients. As you navigate your remote treatment career, keep in mind to focus on self-care, set healthy limits, and look for support when needed.

Study consistently shows that remote treatment is as efficient as in-person therapy for common psychological health and wellness problems. As even more clients experience the ease and convenience of obtaining care in your home, the approval and need for remote solutions will remain to grow. Remote therapists can gain affordable incomes, with potential for greater profits via expertise, private technique, and job innovation.

Content That Brings Browsers into Clients

We understand that it's handy to chat with an actual human when discussing website design business, so we would certainly love to schedule a time to talk to guarantee we're an excellent fit together. Please submit your info below to ensure that a member of our team can help you obtain this process began.

Tax obligation reductions can save self-employed therapists cash. If you do not understand what qualifies as a write off, you'll miss out on out., the Internal revenue service will require receipts for your tax reductions.

There's a lot of debate amongst organization owners (and their accountants) regarding what constitutes an organization meal. Given that meals were often lumped in with entertainment costs, this created a lot of anxiety among company owners who generally subtracted it.

Typically, this indicates a dining establishment with either takeout or take a seat solution. Active ingredients for meal preparation, or food purchased for anything besides prompt consumption, do not certify. To qualify, a meal must be acquired throughout a company journey or shown an organization associate. Extra on organization traveling deductions listed below.

Leaving Behind the Brick-and-Mortar Model

Find out more regarding deducting organization meals. resource If you travel for businessfor circumstances, to a seminar, or in order to provide a talk or promote a workshopyou can subtract the majority of the costs. And you might also be able to press in some vacationing while you go to it. So, what's the difference between a holiday and a company trip? In order to certify as organization: Your trip must take you outside your tax obligation home.

You have to be away for longer than one job day. Many of your time ought to be spent doing company. If you are away for 4 days, and you invest 3 of those days at a meeting, and the 4th day taking in the sights, it counts as a company trip. Reverse thatspend 3 days sightseeing and tour, and someday at a conferenceand it's not an organization trip.

You need to be able to verify the trip was prepared beforehand. The IRS intends to prevent having company owner add specialist activities to entertainment trips in order to transform them into overhead at the last minute. Preparing a composed schedule and itinerary, and scheduling transportation and accommodations well ahead of time, helps to show the trip was largely company relevant.

When making use of the mileage rate, you do not include any kind of various other expensessuch as oil changes or regular repair and maintenance. The only added car prices you can deduct are vehicle parking costs and tolls. If this is your first year having your car, you should compute your reduction making use of the gas mileage price.

Real Talk: Confronting the Obstacles

Some added education costs you can subtract: Supervision costsBooks, journals, and profession publications connected to your fieldLearning materials (stationery, note-taking applications, and so on)Review more regarding deducting education expenditures. resource If you practice in a workplace outside your home, the expense of rent is fully insurance deductible. The expense of energies (warmth, water, electricity, web, phone) is also deductible.

Latest Posts

Relational Approaches to Treatment

Nervous System Response and Recovery

The Science Behind Couples Intensives